2025 Tax Brackets Head Of Household

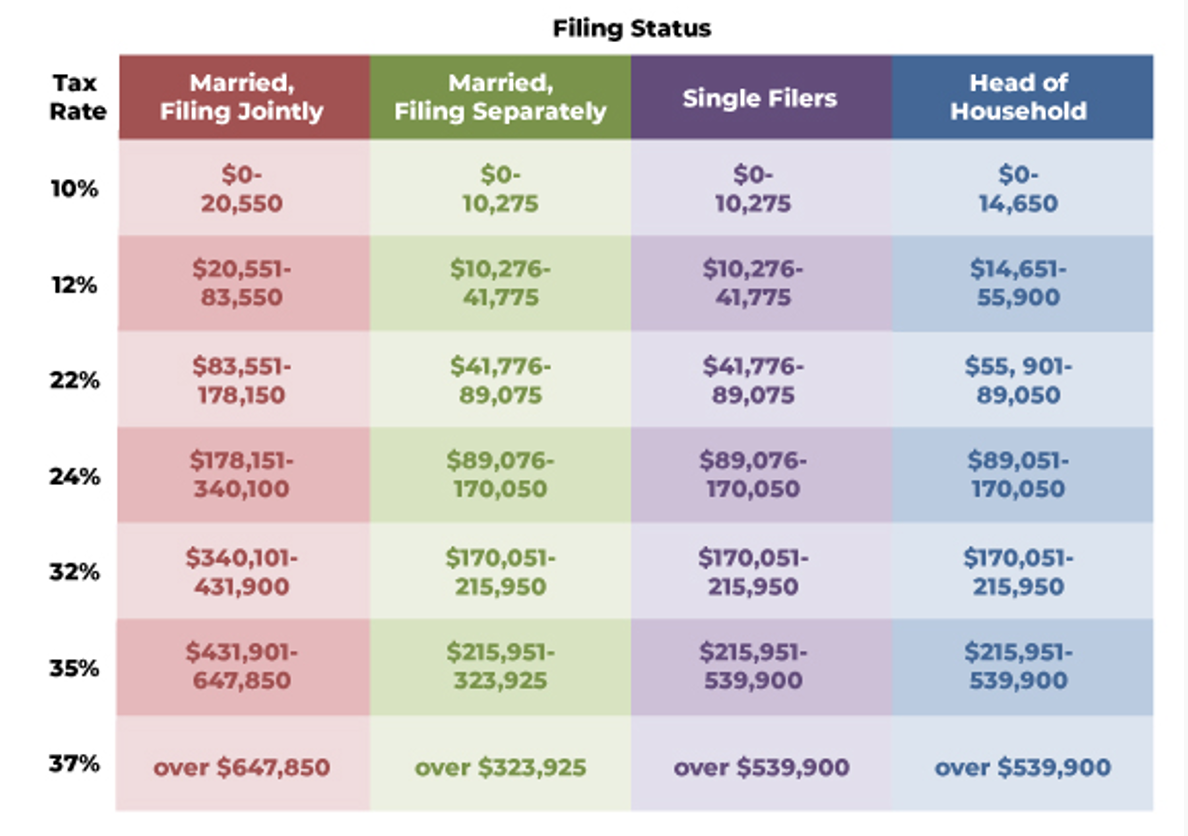

Blog2025 Tax Brackets Head Of Household. The irs has recently released the irs tax brackets for 2025, which is 10% to 37%. Your tax bracket depends on your taxable income and your filing status:

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Ever wonder what the difference is between a single filer and a head of household filer?

Replacing the 10% and 12% brackets with a 15% rate could raise the tax burden on those making less than $47,150 a year.

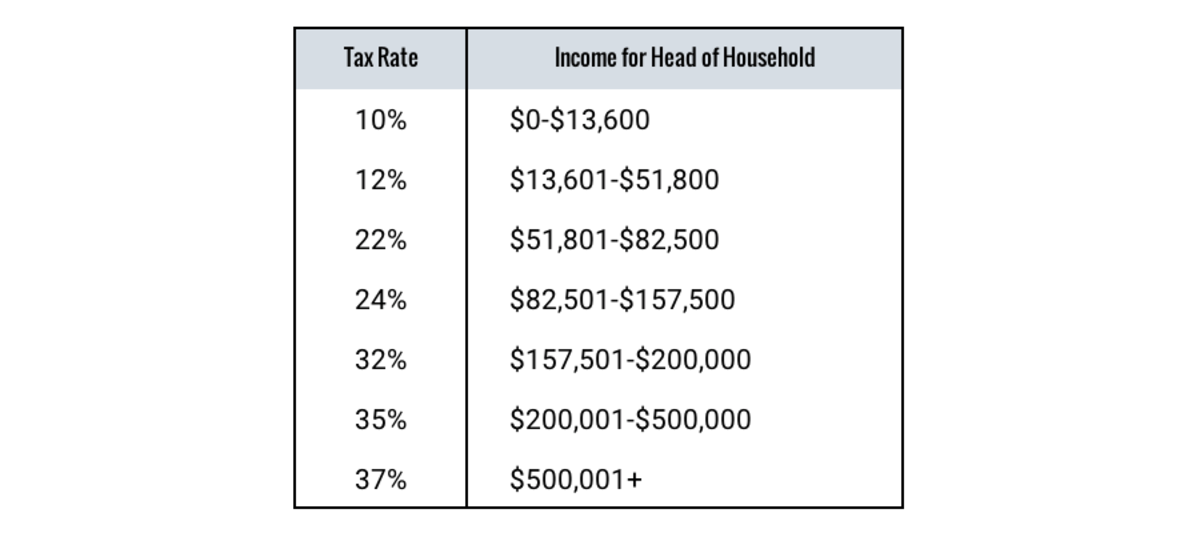

2025 Tax Brackets Head Of Household Erica Blancha, Head of household is the filing type used by taxpayers who are single, but have one or more qualifying dependants living in their household (and pay for more than half of their living expenses). Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax rate schedules and other tax changes.

2025 Tax Brackets Head Of Household Danila Delphine, If you make $70,000 a year living in connecticut you will be taxed $10,235. Head of household is the filing type used by taxpayers who are single, but have one or more qualifying dependants living in their household (and pay for more than half of their living expenses).

Tax Brackets 2025 2025 Nelia Wrennie, Increase in basic exemption limit in budget 2025: The tax brackets are wider for people who file as head of household.

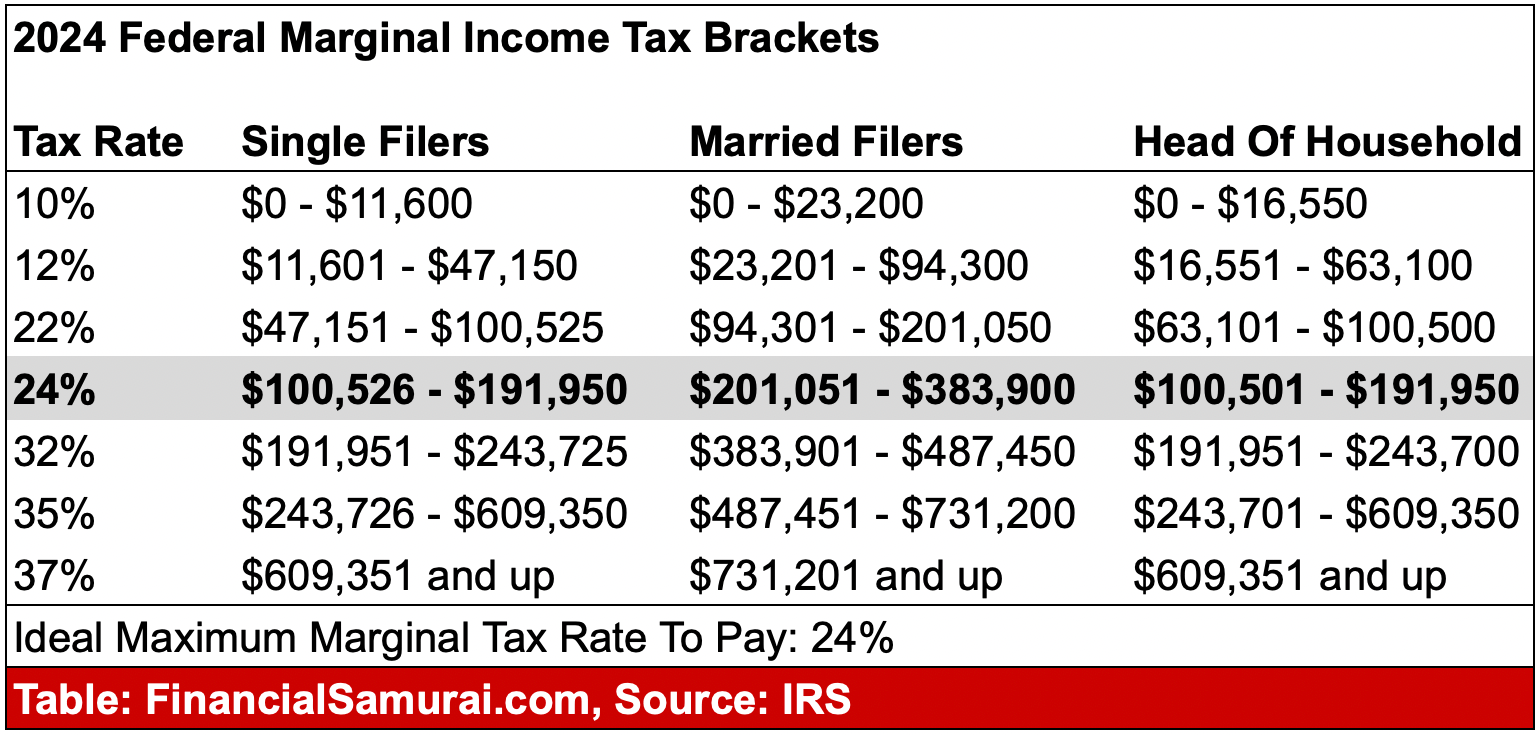

2025 Tax Brackets Vs 2025 Tax Brackets Alina Beatriz, 10%, 12%, 22%, 24%, 32%, 35% and. 2025 tax brackets (for taxes filed in 2025) the tax inflation adjustments for 2025 rose by 5.4% from 2025 (which is slightly lower than the 7.1% increase the 2025 tax year.

2025 Tax Brackets Single Head Of Household Kare Kessiah, Head of household is the filing type used by taxpayers who are single, but have one or more qualifying dependants living in their household (and pay for more than half of their living expenses). Replacing the 10% and 12% brackets with a 15% rate could raise the tax burden on those making less than $47,150 a year.

2025 Tax Brackets Single Head Of Household Inez Madeline, The 2025 tax brackets apply to income earned this year, which is reported on tax returns filed in 2025. 10%, 12%, 22%, 24%, 32%, 35% and.

Tax Bracket 2025 Jamima Selina, Filing as head of household has unique tax benefits meant to offset the cost of supporting a dependant. For the 2025 tax year, the standard deduction will increase by $750 for single filers and those married filing separately, $1,500 for married filing jointly, and $1,100 for heads of household.

Tax Brackets 2025 Head Of Household Bobine Brianna, You can file as head of household if you are unmarried, divorced, have a qualifying child or dependent and paid more than half the costs of running the household where the child or dependent lived for at least half of the year. 2025 tax brackets (for taxes filed in 2025) the tax inflation adjustments for 2025 rose by 5.4% from 2025 (which is slightly lower than the 7.1% increase the 2025 tax year.

Head Of Household Tax Brackets 2025 Nari Tamiko, Replacing the 10% and 12% brackets with a 15% rate could raise the tax burden on those making less than $47,150 a year. Your top tax bracket doesn’t just depend on your salary.

2025 Tax Brackets And The New Ideal Money Wiseup, If you make $70,000 a year living in connecticut you will be taxed $10,235. Here are the 2025 tax brackets, for tax year 2025 (returns filed in 2025).

Head of household is the filing type used by taxpayers who are single, but have one or more qualifying dependants living in their household (and pay for more than half of their living expenses).

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married couples filing jointly.